Residential Solar System Financing Options

We are not in business with Wall Street Bankers so we’ve selected lender options that put YOU in the driver’s seat and not Wall Street Bankers. Programs we offer through our lenders do not include costly dealer fees that can increase the cost of your system by as much as 15%, and

We Won’t Sell You A Lease Because When You Lease A Residential Solar System You Lose Money!

- You lose your 30% tax credit

- You lose adding value to your home

- It can be harder to sell your home

- You pay more for power, and

- Your monthly bill goes up every year – for 20 years!

Yes, if you lease or enter into a PPA Wall Street typically increases the cost of your solar by about 2.99% or more per year, and a lease usually only provides about 20% in monthly savings. It’s a great deal for Wall Street.

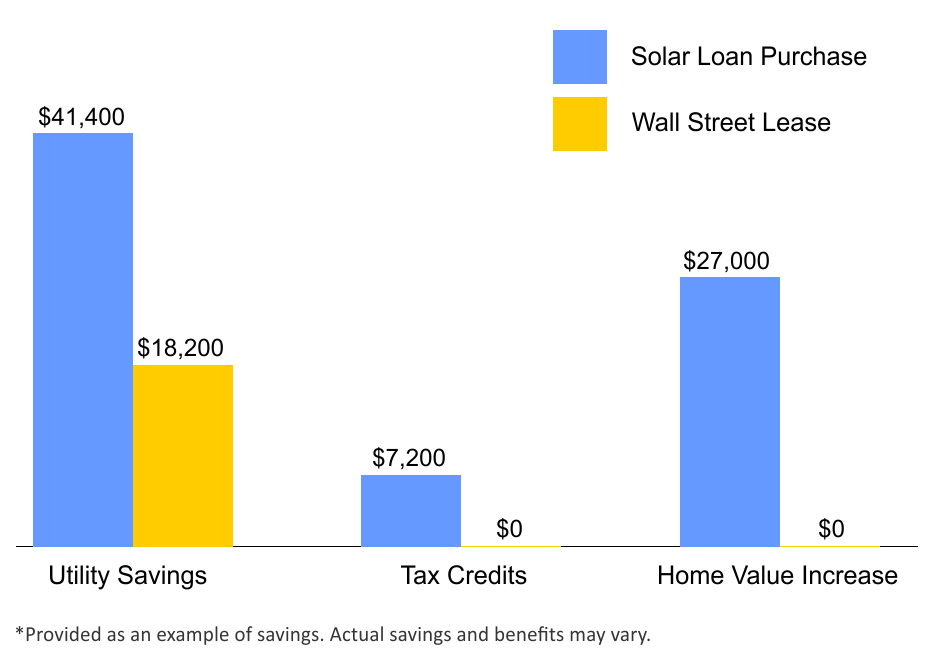

Here Are Some Numbers to Show You Just How Bad Leasing or a PPA Really Are

Let’s say you are installing the XsunX Keep Your Cool 25 package capable of eliminating about $225 per month in utility costs

Because lease payments go up every year by the end of about year seven your lease payment will actually be larger than a typical fixed solar loan payment.

Here’s What the Numbers Look Like by the End of a 20 Yr Solar Lease

Typically, if you can qualify for a solar lease then one of the solar loan programs offered through our lender network is available to you. So don’t let Wall Street bankers put what should be your savings in their pockets.

Financing Solar is a Great Way to Invest in Yourself.

- Your investment generates a return in the form of valuable electricity

- The value of that electricity increases over time making your solar system an appreciating asset

- And, with our zero down, no hassle finance programs you own all of the savings and benefits without having to invest thousands upfront.

Our Programs Include:

Low Interest Conventional Loans up to 15 years

- No Money Down

- You keep the Federal 30% tax credit

- Fixed monthly payments – no surprises like you get with a lease

- Terms from 2 to 15 years

- No pre-payment penalties

HERO Loans – Home Energy Renovation loans

HERO loans allow homeowners to make energy efficiency improvements through a tax assessment on the property. The loans are fixed-rate, low-interest loans issued to qualifying homeowners who are current on their mortgages and property taxes. HERO loans are a great option offering benefits that include:

Not Based on Credit Score

- Approvals for the HERO Program are primarily based on the equity in your home.

No Money Down

- HERO finances 100% of your project cost, with fixed rates and flexible terms of 5-20 years.

Tax Benefits

- You get to keep the Federal 30% tax credit, and the interest portions of your payments maybe tax deductible.

Property Tax Assessment

- HERO payments are made through a line item on your property tax bill so you make payments the same time you pay your property tax once or twice per year.

Transferability

- If you sell, the remaining balance may be able to transfer to the new owner.